THE View From Australia

In this report, we examine results from Best Law Firms’ latest survey of over 500 Australian firms. We also spoke with over 1,300 clients who provided feedback and insights about their experiences with the surveyed firms.

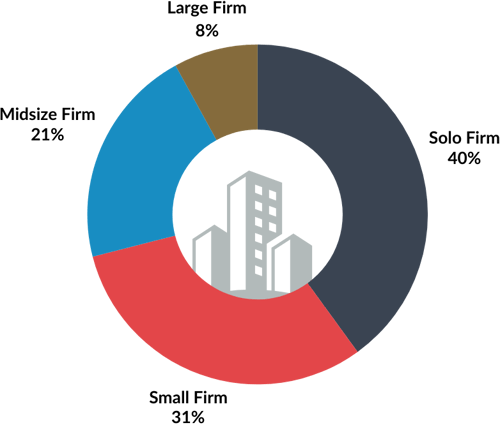

Our data encompasses a broad sample of the market, including global and large firms and, critically, midsize, small, and solo firms for whom reliable benchmarking data can be difficult to obtain. More than half of the responses shared in this report came from Solo and Small Firms.

In this report we discuss:

- The market dynamics and client mix of firms in Australia

- How firms are pitching their services to clients and client engagement efforts

- The marketing strategies firms are using to reach clients

- Key insights from clients about firms

.png?width=430&height=190&name=AU%20Client%20Insights%20Report%20-%20ET%20assets%20(1).png)

Market Dynamics

.png)

Like many countries around the globe, Australia has entered a period of economic uncertainty. Economists recently downgraded its short-term GDP growth projections, as trade and inflation worries continue to reverberate.

In spite of these issues, the Australian legal industry has been on a roll. According to recent data, law firms have been experiencing the most rapid profit growth in a decade, and the legal industry has been outpacing the country’s overall GDP growth rate. Demand for legal services remains high among corporate clients.

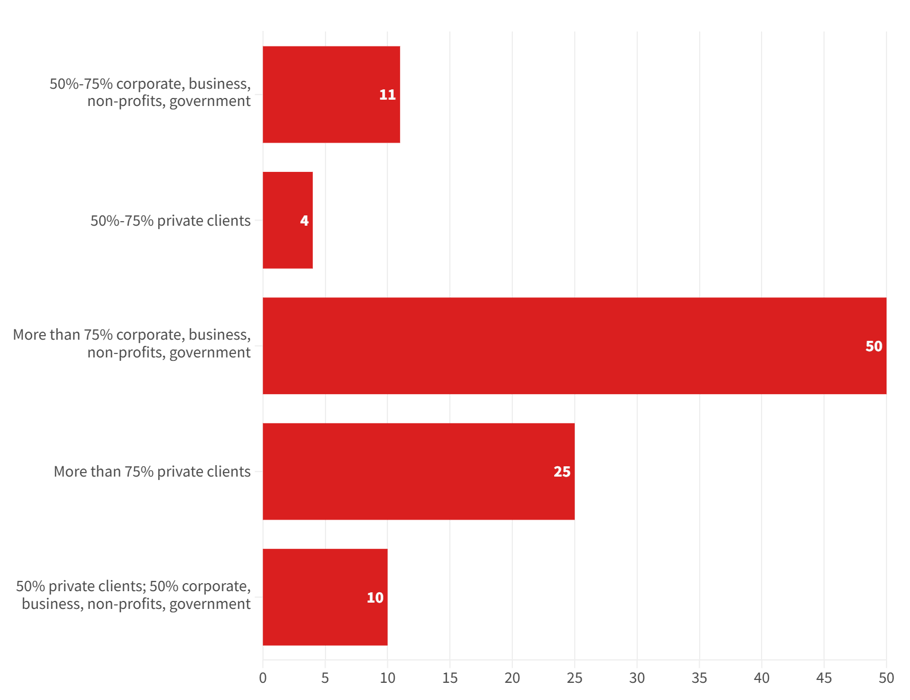

That’s likely welcome news for the 61 percent of firms in our survey who do the majority of their work for corporate, business, nonprofit, and government clients. Among the remaining firms, 29 percent say they are focusing on private clients and 10 percent maintain a 50-50 balance between corporate and private entities.

While the overall numbers show a strong lean toward corporate, business, nonprofit and government clients, the mix grows more diverse as the size of firm decreases. At 90 percent of large firms and 67 percent of midsize firms, three-quarters or more of the clients are being advised on corporate or related matters. At smaller firms and solo firms, however, this statistic is closer to 40 percent, with those firms devoting more time to private clients.

CLIENT JURISDICTION

.png?width=928&height=1200&name=AU%20Client%20Insights%20Report%20-%20ET%20assets%20(6).png)

Most work of the firms we surveyed said their work is squarely focused on Australian clients. Among firms of all sizes, nine out of 10 said 75 percent or more of their business was domestic. Unsurprisingly, the largest firms had the biggest international presence. Just 27 percent of those firms said their Australia offices were focusing solely on local clients, compared to 40 percent of midsize firms, 49 percent of small firms, and 74 percent of solos.

But firms may soon feel more pressure to branch out. Recently released data shows that Australian companies anticipate an increase in international legal spend during the year ahead, a move that could spur firms in Australia to extend their foreign footprints to compete with global players from the U.K. and United States.

The domestic focus is also evident in the limited number of international locations listed by many of our respondents.

.png?width=1016&height=800&name=AU%20Client%20Insights%20Report%20-%20ET%20assets%20(7).png)

Of 534 overseas offices listed by firms, 75 percent (403 offices) were concentrated in just six firms (five large and one midsize). If those firms were removed from the data, the average number of international offices among our respondents would drop from 3.5 to just 0.86 per firm. The firms in our survey said they operated in 358 locations in Australia, an average of 2.3 offices per firm. Among individual firms, the numbers varied widely. One midsize personal injury and class action firm reported 32 locations in all six states and both territories—by far the highest number of the firms surveyed. By comparison, the firm with the next highest number of domestic offices, a large international player, had 14.

Client Engagement

We asked Australian firms, “How do you describe your firm to potential clients?” With help from artificial intelligence, we then analyzed dozens of open-ended responses to examine how firms in Australia pitch themselves to clients and how the messaging differs among firms of various sizes.

Based upon these responses, we found that Australian firms are focusing their pitches to clients on expertise, innovation, specialization, and responsiveness to client needs. Their descriptions emphasized being “trusted,” “award-winning,” “innovative,” “practical" and “client-focused.”

Many firms specifically highlighted their unique approaches to pricing and meeting clients’ financial needs, including fixed-fee or flexible billing arrangements, the absence of billable-hour targets, and providing solutions tailored precisely to each client's specific circumstances. “Carrying an open-ended and unpredictable exposure to legal costs does not help you,” one small firm wrote. “We use costing arrangements that give you certainty and comfort that the risk is managed and under control, using fixed fees and retainer arrangements.”

This word cloud shows the most common words and phrases used by firms when asked how they would describe their law firms and services to prospective clients.

Breakdown by Firm Size

Here’s how firms of various sizes described their services to clients:

- Large Firms: Large Australian firms pitched themselves as a leading national or international players and highlighted their extensive resources and sector-specific expertise. Key practices emphasized included corporate and commercial law, insurance and risk, tax and intellectual property.

- Midsize Firms: Among midsize firms, messaging focused on their ability to provide the comprehensive services traditionally associated with larger firms, but with greater agility, responsiveness and fee transparency. They most often mentioned their corporate, insurance, employment and real estate practices.

- Small Firms: Smaller firms focused on their ability to provide tailored, innovative and efficient services. Like midsize players, they also touted their more flexible fee arrangements, as well as their responsiveness and collaborative approaches. Many of their pitches focused on family law, wills and estates, real estate, class actions, IP and corporate practices.

- Solo Firms: Solo practitioners showcased niche specialization, agility, responsiveness and personal engagement with clients. Their descriptions often highlighted targeted practice areas, primarily family law, estate planning, dispute resolution and real estate.

This heat map shows practice areas emphasized by law firms that were asked how they describe themselves to prospective clients. The darker the color, the more often the practice was mentioned by firms.

Engagement strategies

As part of our survey, law firms answered two key questions about client engagement: 1) whether their firm is actively pursuing new clients, and 2) how they market to prospective clients. For the second question, firms selected all applicable strategies from a list of 14 options. Based on their responses, we identified the top five most commonly used engagement strategies, offering valuable insights into how leading firms are attracting new business.

The responses make two things clear. One, Australian firms are on the hunt for new clients—with nearly all firms saying they are actively seeking new engagements. And two, they are embracing an omnichannel marketing approach as they attempt to reach those prospects.

On average, Australian firms are deploying seven or more types of marketing—a figure that is relatively consistent no matter the size of the firm.

.png?width=394&height=500&name=AU%20Client%20Insights%20Report%20-%20ET%20assets%20(8).png)

.png?width=1306&height=830&name=AU%20Client%20Insights%20Report%20-%20ET%20assets%20(13).png)

Particularly popular are efforts that often require a personal touch—such as client and referrer events industry and community speaking engagements. Those strategies, along with referral/word-of-mouth campaigns, LinkedIn, rankings and awards, and thought leadership are being deployed by more than three-quarters of law firms across the country.

.png)

- Board positions

- Client and referrer events

- Digital advertising

- Industry and community speaking engagements

- Mass market advertising e.g. billboards, print media, etc.

- Paid SEO

- Paid social media campaigns

- Proprietary research and publications

- Rankings and awards

- Referral or word-of-mouth campaigns

- Sponsorships

- Thought leadership articles, blogs and podcasts

- University teaching and engagement

Unlock Deeper Insights About Your Firm

Connect with our research team to learn what your clients are saying, how your firm benchmarks against peers, and strategies to strengthen your performance in next year’s research cycle.