THE View From SPAIN

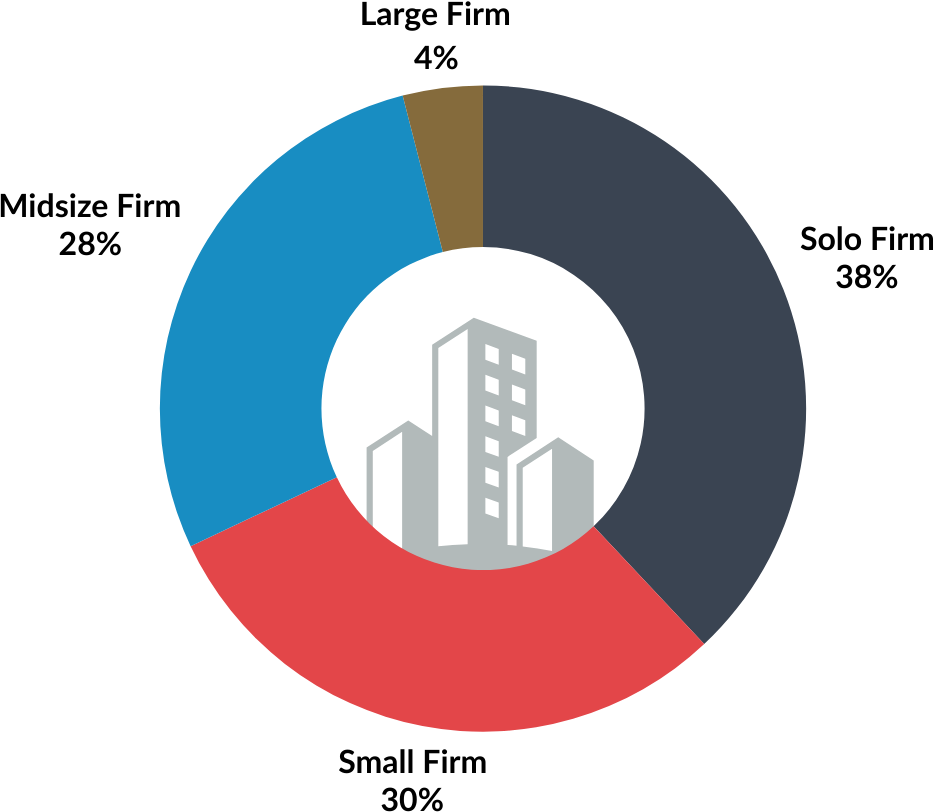

In this report, we examine results from Best Law Firms’ first survey of law firms and clients in Spain. Our responses come from an elite list of more than 200 firms with Spanish offices, each of which has at least one lawyer who has been ranked by us for their accomplishments and expertise. We also spoke with 900 clients , who provided feedback about their experiences with firms. Our data encompasses a broad sample of the market, including global and large firms and, critically, midsize, small, and solo firms for whom reliable benchmarking data can be difficult to obtain.

In this report we discuss:

- The market dynamics and client mix of firms in Spain

- How firms are pitching their services to clients and client engagement efforts

- The marketing strategies firms are using to reach clients

- Insights from clients about firms.

Market Dynamics

The Spanish economy has been outpacing its fellow euro zone countries, driven by increased tourism, industrial production, and consumer spending. For the legal industry, economic growth presents new opportunities to win clients, particularly as mergers and acquisitions and litigation work are expected to surge.

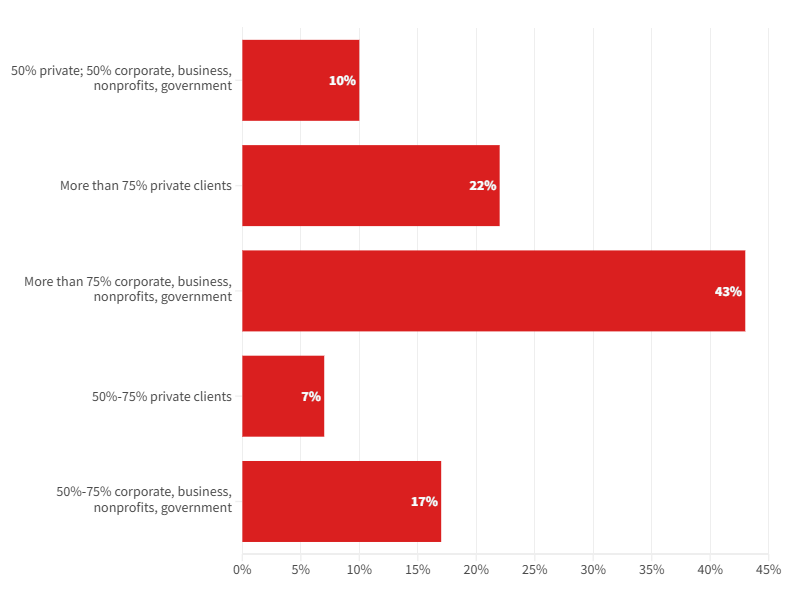

The increase in M&A and litigation should be especially good news for the 61 percent of firms in our survey who are doing the majority of their work for corporate, business, nonprofit, and government clients in Spain. The remaining 39 percent said they are focusing on private clients, particularly high-net worth individuals and families.

The 204 respondents to our survey currently operate more than 400 offices in the country. While the average number of offices per firm is two, data for individual firms varies widely, with a few large and midsize firms boasting as many 14 offices.

On average, firms operating in Spain have 11 other offices globally, although that number is skewed by one international firm with hundreds of locations worldwide.

Without that firm, the average number of global offices declines to four—which indicates many of the players surveyed are deeply invested in the Spanish market. It also reflects the predominance of midsize and smaller firms in our survey.

Several large firms have said recently that they intend to grow in Spain as demand for legal services surges. The smaller and midsize firm respondents in survey—particularly those with significant corporate, transactional, and business law practices— are likely to be among those courted for acquisitions or whose partners will be targeted for recruitment by international firms entering or expanding in the market.

Client Engagement

We asked the firms, “How do you describe your firm to potential clients?” And with the help of artificial intelligence, we then analyzed dozens of responses to determine how firms in Spain pitch themselves to clients and how the messaging differs among firms of various sizes.

Overall, Spanish firms are broadly positioning themselves around client-centric values, and they are emphasizing their ability to provide personalized attention and tailored solutions for clients. Many firms are touting their multidisciplinary approach and their ability to provide comprehensive services.

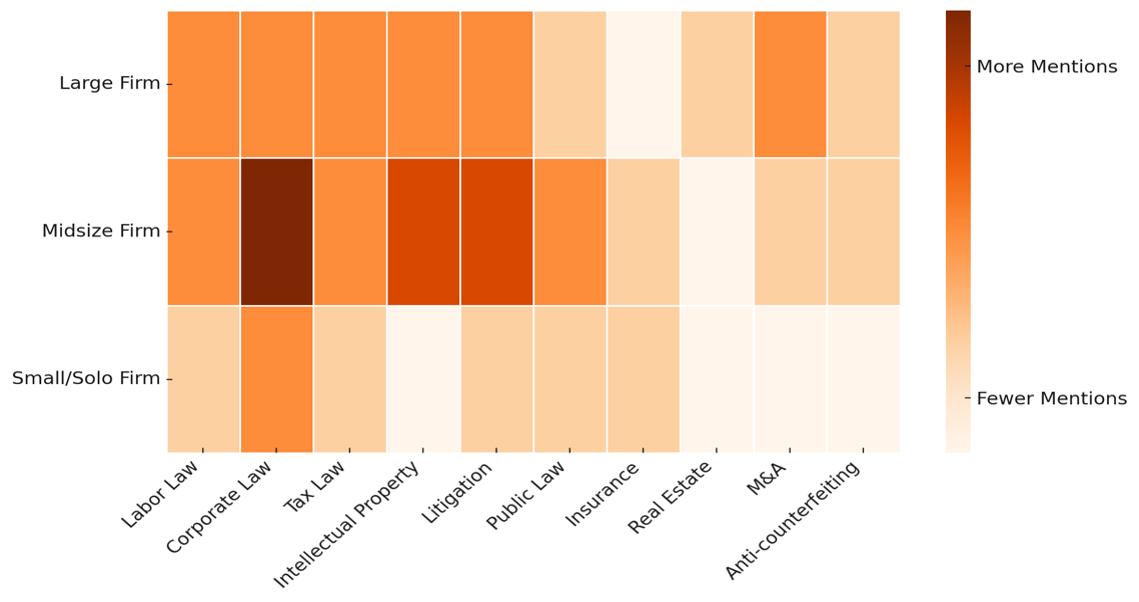

Corporate, labor, intellectual property, and tax were the most commonly mentioned practice areas, as were mergers and acquisitions, corporate governance, compliance, and litigation. (Midsize firms, in particular, highlighted their IP capabilities.) A number of firms are also keen to emphasize their international prowess and presence in multiple jurisdictions, particularly for businesses requiring assistance with cross-border matters.

This word cloud shows the most common words and phrases used by firms when asked how they would describe their law firms and services to prospective clients.

Breakdown by Firm Size

Here’s how firms of various sizes described their services to clients:

- Small and Solo Firms: In their responses, smaller firms highlighted their accessibility, closeness to clients, and local strength. They also stressed personal communication, flexibility, and tailored services for individual clients. Solo practitioners underlined their niche practices, especially technology and startup-related work, as well as their ability to provide personalized service to specialized clients.

- Midsize Firms: Among the key themes midsize firms emphasized were modernity and adaptability. They also cited their ability to offer multidisciplinary capabilities, or as one firm put it, “comprehensive, committed, ethical and responsible guidance.” Intellectual property, public law, sports and entertainment, and corporate law were among the practices most frequently showcased.

- Large Firms: International reach and comprehensive multidisciplinary expertise were high on the list of keywords and themes generated by larger firms. They frequently underscored their labor, corporate, and tax law prowess, as well as their global and international scope.

This heat map shows practice areas emphasized by law firms that were asked how they describe themselves to prospective clients. The darker the color, the more often the practice was mentioned by firms.

Engagement strategies

It may come as no surprise that most of the firms we surveyed are on the hunt for additional work. Among the firms that responded to the question, “Is your firm actively trying to engage new clients,” nine out of 10 said, “yes.”

All of the large firms and 97 percent of midsize firms said they were looking for new prospects. The numbers were only slightly lower for solo practitioners (92 percent) and small firms (87 percent).

To gauge their capacity, we also asked solos, small, and midsize firms to provide an estimate of the number of active clients in Spain being served by their firms.

.png?width=564&height=708&name=Spain%20Client%20Insights%20Report%20-%20ET%20assets%20(2).png)

.png?width=830&height=830&name=Spain%20Client%20Insights%20Report%20-%20ET%20assets%20(3).png)

Among all firms in these categories, the average number of clients was 104. On an individual basis, of course, the number of clients varied substantially. Among solos, for example, the range of clients started at six and ran as high as 900. Small firms reported a range of five to 1,200 clients, and midsize firms reported eight to 4,000 clients.

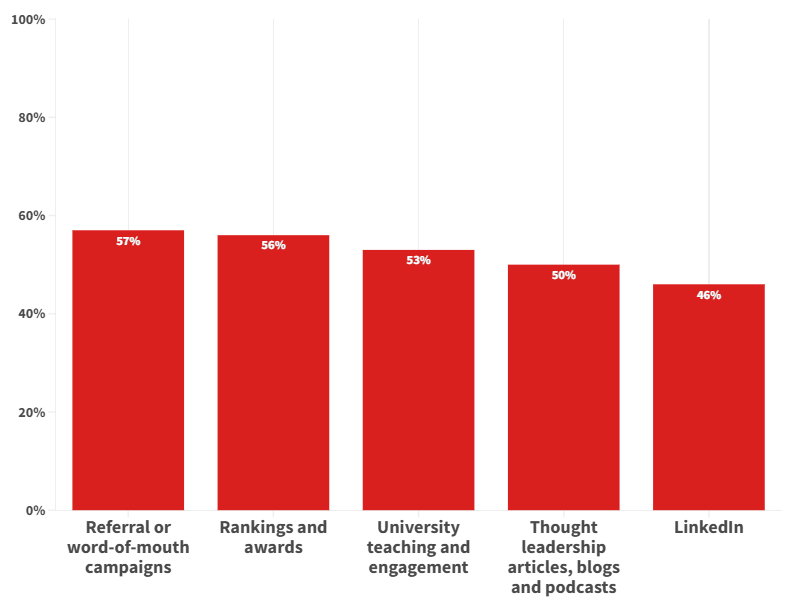

Our survey asks law firms “how does your firm market to new potential clients?” and provides them with a list of 14 separate marketing strategies from which to choose. The results show that firms in Spain have embraced an omnichannel marketing approach to reach prospects. On average, they deploy four or more marketing strategies, a figure relatively consistent across large, midsize, and small/solo firms.

- Board positions

- Client and referrer events

- Digital advertising

- Industry and community speaking engagements

- Mass market advertising e.g. billboards, print media, etc.

- Paid SEO

- Paid social media campaigns

- Proprietary research and publications

- Rankings and awards

- Sponsorships

- Thought leadership articles, blogs and podcasts

- University teaching and engagement

- Other

- Referral or word-of-mouth campaigns

.png)

More than half of Spain’s firms are using four key strategies: traditional word-of-mouth and referrals; rankings and awards; university teaching and engagement; and thought leadership. Among social media and digital options, LinkedIn is the most popular option. The mix of strategies indicates that firms in Spain are focusing on marketing approaches that establish their expertise and authority to specific niches. Options that appeal to broader audiences are the least used among the engagement strategies we suggested. This includes mass market and digital advertising, paid social media, and paid SEO.

Unlock Deeper Insights About Your Firm

Connect with our research team to learn what your clients are saying, how your firm benchmarks against peers, and strategies to strengthen your performance in next year’s research cycle.